Including a Discretionary Testamentary Trust in your will offers your beneficiaries more choice about how they receive their gift, whilst providing significant asset protection and tax advantages. Yet many people are unaware the process is as simple as setting up the 'rules of the trust' as part of their estate planning.

How does a Testamentary Trust work?

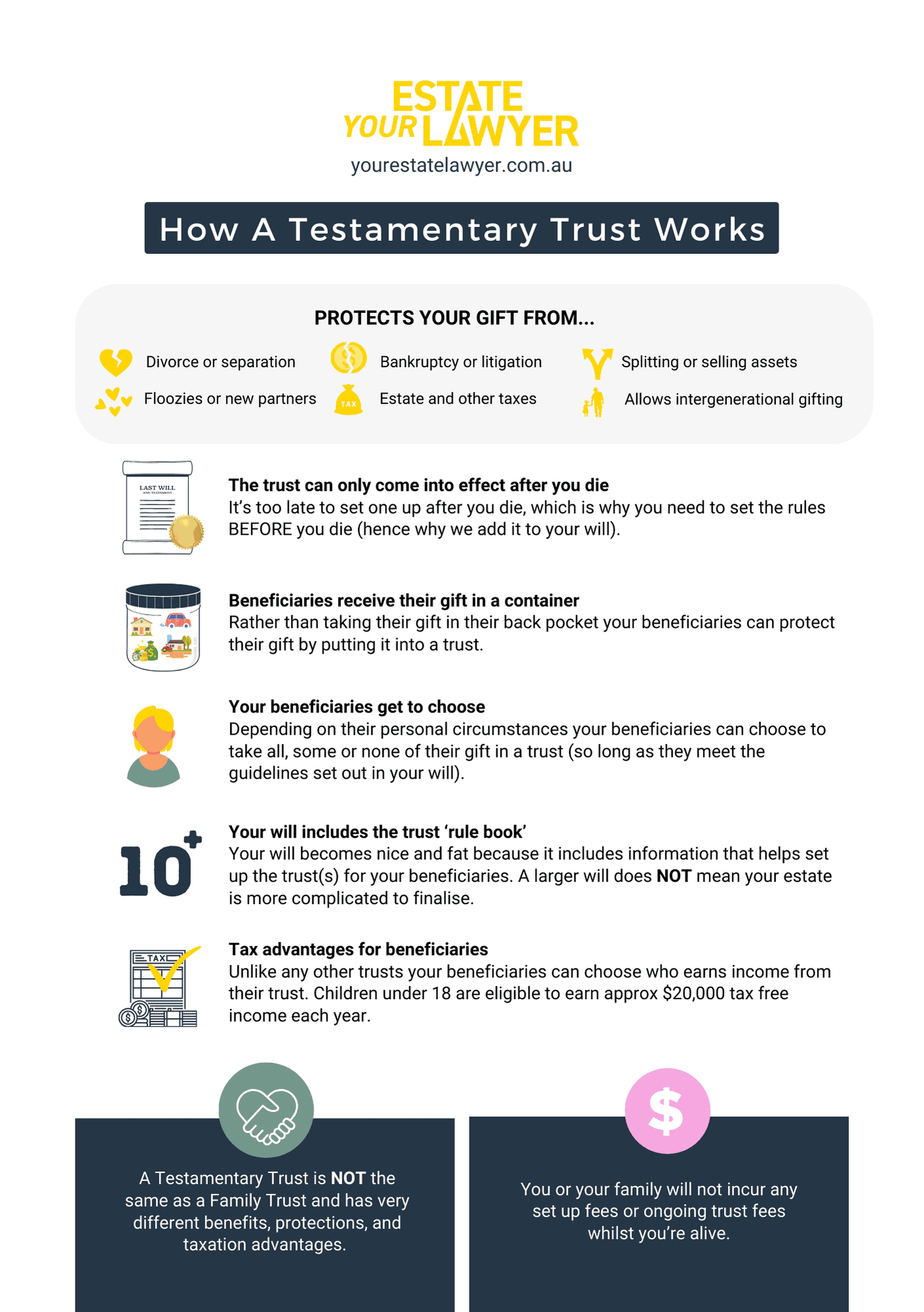

Unlike an Inter Vivos trust (a trust set up and operated in your lifetime, such as a Family Trust) a Discretionary Testamentary Trust is created in your lifetime but doesn't come into effect until after your death. It relies on your will to outline the terms of the trust and your beneficiaries to set it up (if they choose).

Because none of us know what life is going to look like for our beneficiaries at the time of our death, including a Testamentary Trust in your will is a huge gift to your and offers them a level of choice around how to receive their inheritence depending on their personal circumstances.

What does a Testamentary Trust protect or provide?

Creditor Protection: can protect your gift from debts that a beneficiary or their spouse may be responsible for, provide protection if beneficiaries have an addiction or other problems handling money, and protect individual beneficiaries who may be at risk of litigation due to a high-risk business or job.

Divorce: assets held in the trust are not assets of any individual and cannot be included in any distribution orders given by the Family Court.

Education: bequests left to provide tuition fees or other support for grandchildren is more effective being gifted through a testamentary trust than leaving additional bequests to their parents.

Succession: the trust protects assets that you may wish to provide for a spouse with assurance assets will flow through to your biological children or grandchildren and not be diverted to a new family.

Protected people: where you need to ensure beneficiaries with a physical or intellectual disability are protected.

Tax benefits: income generated by the trust can be distributed tax-free to beneficiaries at the marginal tax rate, including children under 18.

A testamentary trust makes my will so much bigger, do the extra pages mean my estate will be more difficult to finalise?

This is a common question and the answer is 'absolutely not'! A small will isn't necessarily a simple will.

The additional pages in your will are the "rule book" for the trust. This provides an accountant with all the information required to set up the trust in the way you want. If anything including a testamentary trust makes your estate easier to administer as beneficiaries have a lot more choices around how to recieve their inheritance.

What if my beneficiaries don't want a trust?

If your beneficiaries satisfy the terms set out in your will (ie they're not going through a marriage breakdown, aren't bankrupt, are able to manage their own money, and meet the age criteria you have set out) they have the choice to receive all or some of their inheritance through the trust. Or they can opt out of opening a trust altogether.

Each beneficiary can decide according to their own circumstances - one beneficiary may choose to open a trust whilst the other may choose to take their gift outright.

If you don't include a trust deed in your will your beneficiaries are unable to create one after your death, even if they believe that would be the best way for them to protect or manage their inheritence.

Can my beneficiaries set up a Testamentary Trust if I don't include it in my will?

No. After your death, you cannot come back and re-write your will to include a Testamentary Trust (or anything else for that matter!).

If you think there is any chance your beneficiaries will benefit from the protections or provisions granted by a Testamentary Trust, now or at any point in the future, it's savvy estate planning to include one in your will.

Does my estate have to be substantial?

We recommend beneficiaries receive financial advice to ascertain if the income generated by your estate will be sufficient to warrant the ongoing and set-up costs of a trust.

However, assets owned (or purchased) by your beneficiaries can also be held within their Testamentary Trust, which may add weight to your decision to include one in your will.

For many beneficiaries, a testamentary trust is a valuable way of protecting even a small inheritance from things such as a relationship breakdown, financial difficulties, or to distribute assets across generations.

If you're uncertain about what the future holds for your beneficiaries, we suggest you include the trust as an option in your will, allowing them to make the decision that's right for their personal circumstances at the time.

I've heard it's expensive and time-consuming for my family to set up a trust, is that right?

Creating a will that includes a trust deed will cost you slightly more than a standard Simple Will. However, we believe this is a small price to pay for the gift of choice it offers your beneficiaries.

As the trust isn't created until after your death you don't incur any set-up or management costs in your lifetime.

If your beneficiaries choose to receive their inheritance through a trust any set-up and management costs will be their responsibility - for most beneficiaries these expenses are negligible compared to the financial and taxation benefits of holding assets in a trust. We recommend your beneficiaries seek independent financial and accounting advice, that takes into consideration the cost benefits of setting up an estate Vs the financial benefits, before making their final decision.